There is nothing to set up. You have to add your GSTIN (if you have), your address and you are good to go.

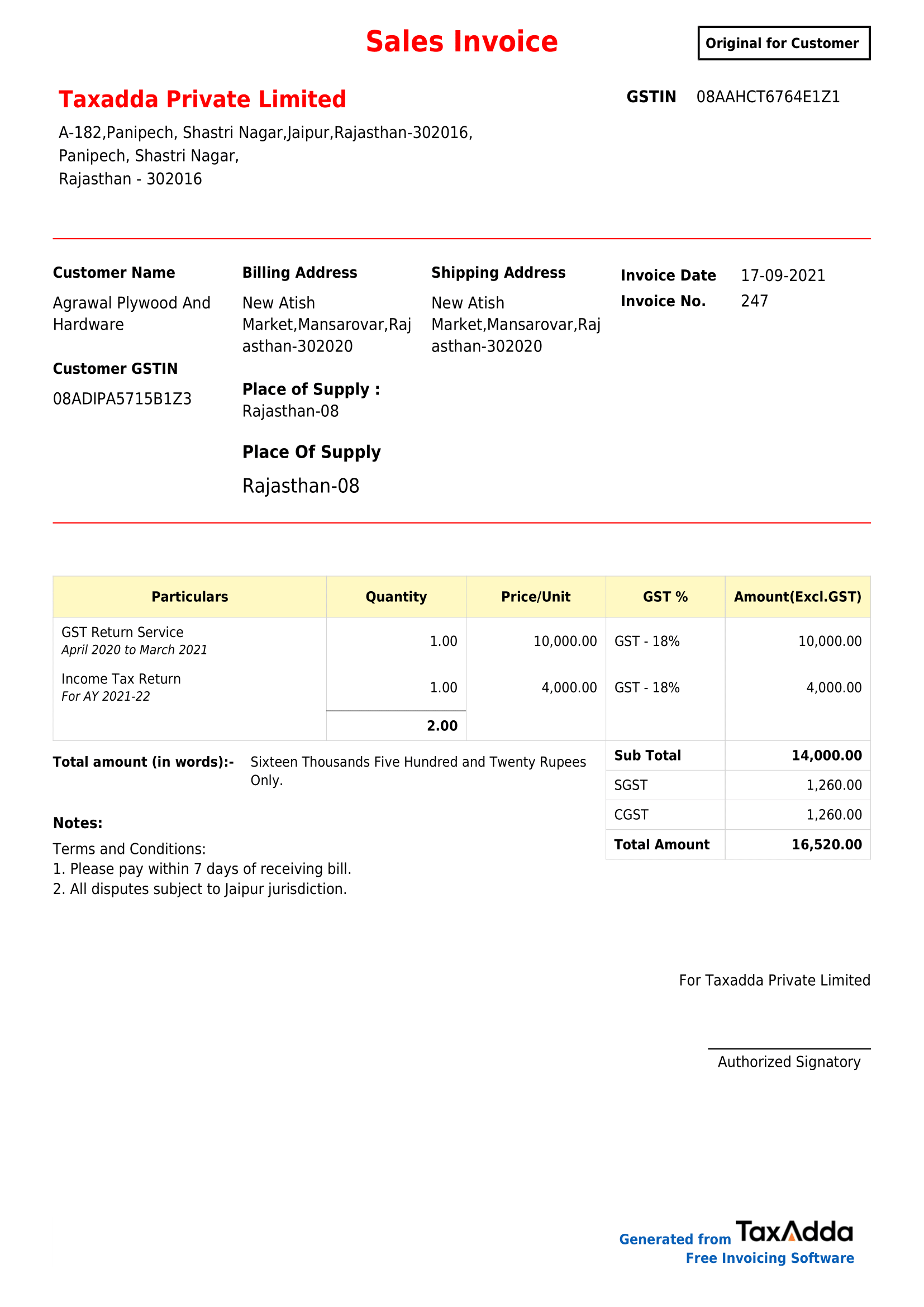

Select customer, products and GST rate and your invoice is created.

It’s easy, yet invoicing format is customizable. There are options to add logo to invoices, add terms and conditions, print invoices in duplicate or triplicate.

Manage inventory and customer/supplier accounts in easy to use interface.

Prepare GST returns in a click. Json file is also created which you can upload directly on Goods and service tax portal.

Filing GST returns is now very easy.

Web based Applications provides a number of benefits over traditional installable software. It is simple to use and

Backups are taken automatically. No risk of data loss.

It’s a perfect billing software for small businesses whether professionals, other service providers, retail shop or wholesale shop.

Many features like Copy Invoice, Save and Copy, omni search etc are given which saves a lot of time for users.

You have to enter GSTIN of customer or supplier and all details will be auto-filled from GSTN server.

Inventory management lets you keep track of your physical stock.

Many persons use excel, word or invoice generator but these options are not as feasible as a online application.

Application is secured with 256 bits encryption. We use highly secured Amazon Aws servers only.

Automatic backups of databases are taken daily on secured cloud based servers.

Add any number of users and share access to them with view only right or edit right.

Activity in each transaction by each user is recorded. You can see which user has created transaction or edited transaction and at which date and time.

You can also create credit notes, debit notes, sales order, purchase order, delivery challan, estimates/quotation/proforma invoices.

It also give you best tracking of invoices. When you convert a sales order into sales invoice, you can track afterwards from which sales order that sales invoice was created and also opposite.