* If the GSTIN is registered in last 3 days, then error message of "Record Not Found" may come.

What is the use of this validator?

This GSTIN validator can be used for checking that the structure of GSTIN is correct or not. Please note that if the structure of a GSTIN is correct then it doesn't mean that such GSTIN exists. Check for details of GSTIN or whether GSTIN exists or not by using Search GSTIN functionality.

How to use this?

Type or copy/paste the GSTIN you have. If the GSTIN structure is correct then it will show GSTIN is correct and you can search for the details of GSTIN.

If the GSTIN structure is not correct then it will show the mistakes in structure in the following ways

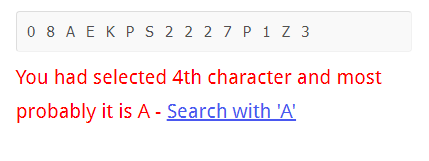

- When there is an alphabet where there should be a number or vice versa. For example – 7th Character should be an alphabet and not a number. If you have typed the whole GSTIN then it will also show the probable number like this

Click on Search with A and it will replace 6 (7th character) with A and then you can proceed.

Click on Search with A and it will replace 6 (7th character) with A and then you can proceed.

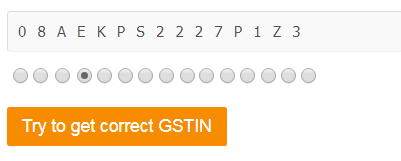

- When the structure is valid but still showing incorrect GSTIN. We can get that GSTIN is incorrect from the checksum digit. The last i.e 15th character of GSTIN is the checksum digit. It is derived by a mathematical formula on the basis of first 14 characters. In this case, 15 radio buttons come below the box like this

You can select the radio button below the character on which you have doubt to be incorrect. And click on Try to get correct GSTIN. The validator will try for all combinations for A to Z in case of alphabet place or 0 to 9 in case of number place. And if any combination results in correct GSTIN structure, it will show results.

You can select the radio button below the character on which you have doubt to be incorrect. And click on Try to get correct GSTIN. The validator will try for all combinations for A to Z in case of alphabet place or 0 to 9 in case of number place. And if any combination results in correct GSTIN structure, it will show results.

When to use this validator?

If you have a GSTIN written in bad handwriting or which GST portal is showing as invalid, you can use this validator to get a possible correct GSTIN. This doesn't work in each and every condition but can be a useful tool at times.

What is the correct GSTIN structure?

GSTIN is of 15 characters.

The structure in detail is as under

- First 2 character is number and is the state code or union territory code. It will be from 01 to 37.

- Third to twelfth characters is PAN. Third to Fifth character is alphabets. It could be any alphabet.

- Sixth character is alphabet and it depends on the type of assessee.

| Alphabet | Type of Assessee |

| A | Association of Persons (AOP) |

| B | Body of Individuals (BOI) |

| C | Company |

| F | Firm |

| G | Government |

| H | HUF (Hindu Undivided Family) |

| L | Local Authority |

| J | Artificial Juridical Person |

| P | Individual or Proprietor |

| T | Trust (not as in A – AOP) |

- 7th Character is first alphabet of surname in case of individual. In case of other assessees, it would be the first alphabet of the name of assessee. For example – In case GSTIN is to be issued in name of Prateek Agarwal, 7th character will be "A".

- 8th to 11th character is radom numbers.

- 12th character is PAN checksum. It is a aplhabet.

- 13th character is the entity number of the same PAN in the state.

- 14th character is alphabet "Z".

- 15th character is the checksum. It is derived by a mathematical formula on the basis of first 14 characters. Checksum is used in various areas to check the validity of a number without searching in the database. Along with GSTIN, it is used in debit card and credit card numbers.

You can get a new GSTIN using TaxAdda's GST Registration Service

Which details of GSTIN will be displayed

The following details will come for existing GSTIN –

- Trade Name

- Legal Name

- Status – Active or Inactive

- Registration Date

- Business

- Dealer Type

- Entity Type

- Address

The details are fetched from the GSTN portal using API given by government itself (Through GSP). So the data is always authentic and up to date.

Where to complain about Fake GSTIN?

You can complain about fake GSTIN on emailhelpdesk@gst.gov.in or can call at +91 124 4688999 / +91 120 4888999.

FAQs

You can search for GSTIN in a GSTIN searcher like TaxAdda's tool. If the GSTIN is wrong then it will show No records Found.

Yes, use the TaxAdda's GSTIN search and address will be displayed for that GSTIN. But contact details like email and mobile number is not available.

All GSTIN search tools shows that the GSTIN is active or not. If GSTIN is not active then date of cancellation is also shown.

No, such facility is not provided by GSTN portal and therefore cannot be accessed by other tools also. Although you can get GSTIN by PAN on gst.gov.in

GSTIN can be verified before making purchase or sales. If GSTIN of vendor is wrong then you may face problem in taking ITC. If GSTIN of customer is wrong then you will face problem in filing returns.