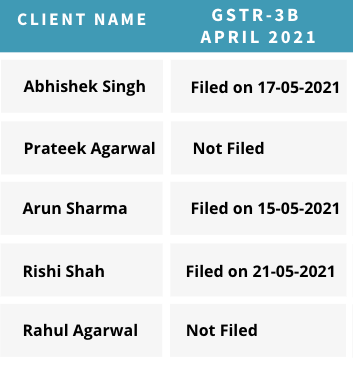

Confirm Return Status

Just click a button and return status of all clients will be updated. You can confirm that any return has not remained filing or verification by OTP.

No more mistakes!

Use as Task Manager

GST return status is saved along with filing date. If status is Not filed then time of last check is saved. This can work as your task manager.

No more tracking in excel !