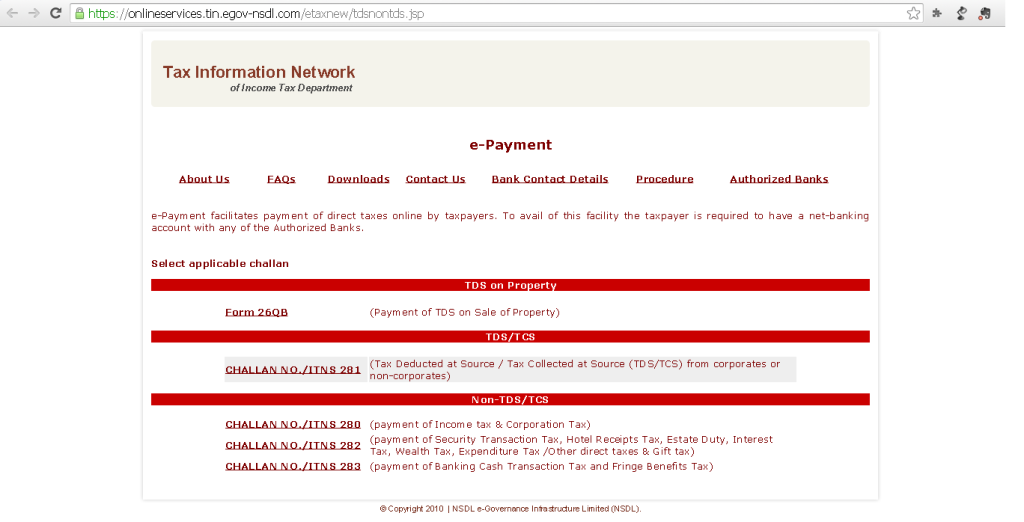

Step 1 – Go to https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Step 2 – Select Challan No./ITNS 280

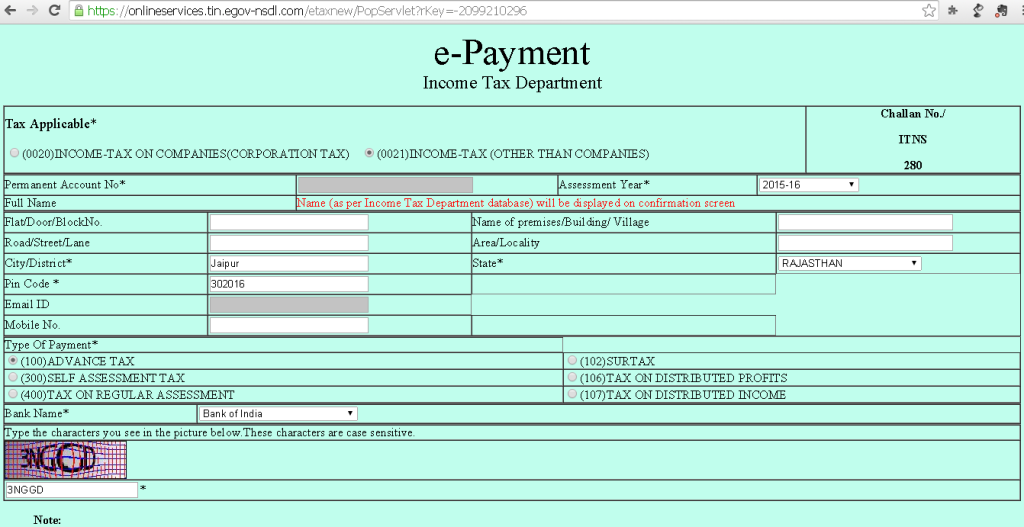

Step 3 – Select the type of assessee for which income tax payment being made. If you are making payment for a company then you should select (0020) Income Tax on Companies (Corporation Tax) otherwise select (0021) Income Tax (Other than companies) for individual, huf, partnership etc.

Step 4 – Enter the PAN number and other details of the assessee.

Step 5 – After that you have to select the type of tax payment.

Step 6 – Select the bank from which payment is being made.

Step 7 – Enter the verification code and select Proceed.

Step 8 – Check the details again and make sure that the name of the Assessee is matching.

Step 9 – Select submit to bank and then you will be proceed on the bank website. The option of entering the amount and other details will be available on the bank website.