Meaning of Seafarer

A sailor, seaman, mariner or a seafarer is a person who navigates water bone vessels or assists as a crew member in their operation and maintenance.

Seafarer holds a variety of ranks and professions, each of which carries unique responsibilities which are integral to the successful operation of an ocean-going vessel. A common deck crew for a ship includes Captain / Master, Chief Officer/ Chief mate, Second officer/ Second mate, Able seaman, Ordinary seaman, Deck cadets etc. A common engine crew will include Chief Engineer, 2nd Engineer, 3rd Engineer, 4th Engineer (optional), Engine Cadet, Fitter, Motorman, Oiler etc. Other than this saloon staff will comprise of Chief Cook and General Stewart but the number and rank of crew members serving on a ship will vary according to the size of the vessel, trade area of the vessel, Minimum Safe Manning certificate, administration etc.

How Seafarer Earns

Seafarer generally receives remuneration in the form of salaries from the companies.

Income Tax on Seafarer for FY 2020-21

The taxability of salary received by a seafarer is based on the residential status of the seafarer.

RESIDENT SEAFARER

The salary received by a resident seafarer will be taxable as per the laws of the Income-tax department. No special exemption is available.

NON-RESIDENT SEAFARER

The salary of a non-resident seafarer will NOT be included in the total taxable income of the seafarer.

Meaning of Non-Resident Seafarer

An individual is said to be Non-Resident Seafarer if he is outside India for 184 days or more during the financial year (185 days or more in case of a leap year) for the purpose of employment. If he is not then he will be treated as a resident seafarer.

Calculation of period outside India

Rule Applicable for Voyages Start and End Outside India

Stamping dates in the passport is the basic criteria for calculation of the period outside India. Generally, passport dates are used when you join and sign off from ship outside India. However, dates of the CDC are the conclusive evidence at the time of scrutiny that you are outside India for the purpose of employment.

Use NRE DAYS CALCULATOR to find out your resident status

Rule Applicable for Voyages Start or End in India

However when you join or sign off from India then the CDC dates shall be used for calculation of period outside India.

As per Notification No. 70/2015/ F.No.142 /12/2015-TPL, the period beginning on the date entered into the Continuous Discharge Certificate (CDC) in respect of joining the ship by the individual for the eligible voyage and ending on the date entered into the Continuous Discharge Certificate in respect of signing off by that individual from the ship in respect of such voyage.

“Eligible voyage” shall mean a voyage undertaken by a ship engaged in the carriage of passengers or freight in international traffic where-

(i) for the voyage having originated from any port in India, has as its destination any port outside India; and

(ii) for the voyage having originated from any port outside India, has as its destination any port in India.

Notes:-

- Sum of all the period (which satisfies above conditions) should be used when there are multiple voyages in a single financial year. For example, if there are 2 voyages for a period of 100 days and 90 days during FY 2019-20 then the period outside India will be 190 Days.

- The period of the voyage should be calculated considering the financial year. For example, if a voyage started on 01 Dec 2019 and end on 01 May 2020 then the period outside Indian will be from 01 Dec 2019 to 31 March 2020 for the FY 2019-20 & from 01 April 2020 to 01 May 2020 for the FY 2020-21.

- Both the stamping date (starting and ending) will be considered as date outside India. For example, if the starting stamp date 01 April 2020 and ending stamp date is 30 April 2020 then the period outside India shall be 30 days. There are various case laws which specifically suggest that the date of departure will be considered outside India. However, for the date of arrival is also considered outside India in some of the decision of ITAT or calculation is required to be done on an hourly basis. So, it’s best if you have clear 185 days or more in your CDC.

- If a ship spent time in Indian territorial waters then it will be counted as period outside Indian if it is part of the eligible voyage.

Other related things:-

- If a person status is non-resident for one of the sources then he will be treated as a non-resident for all the sources of income.

- Interest earned on NRE saving bank account is exempt from Tax for all the individual.

Special Circular Issued by CBDT for Non-Resident Seafarer

As per Circular No. 13/2017 issued by Central Board of Direct Taxes, salary accrued to a non-resident seafarer for services rendered outside India on a foreign ship shall not be included in the total income merely because the said salary has been credited in NRE account maintained with an Indian bank by the seafarer.

This circular specifically clarify if below conditions are met then the salary received will not be included in the total income of the individual

- Non-Resident seafarer

- Service rendered outside India

- Foreign Ship

- Credited to NRE Bank account

However, it does not mean if you have received a salary from an Indian flagship then it is taxable as above circular is silent in this case. The above circular is just a clarification issue by CBDT for a specific condition.

IN MY OPINION, IF YOU ARE A NON RESIDENT SEAFARER THEN THE SALARY RECEIVED SHALL NOT BE INCLUDED IN YOUR TAXABLE INCOME.

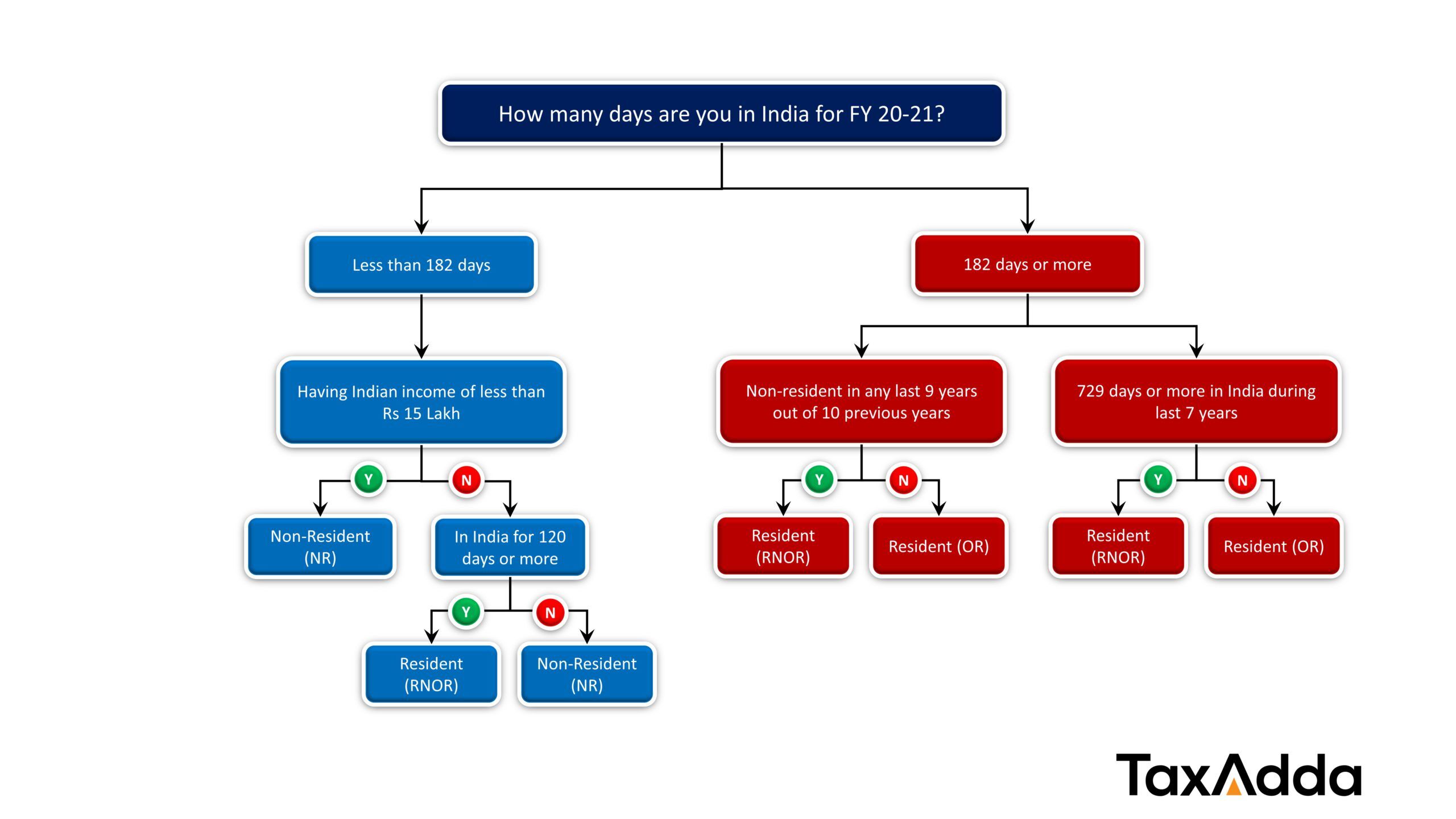

New Deemed Resident Provision from FY 2020-21

This amendment is only applicable on seafarer who is outside India for more than 184/185 days during the year and having Indian income of more than fifteen lakh. An amendment has been made by Financial Act 2020 which is applicable beginning from the financial year 2020-21 (01st April 2020 to 31st March 2021). The amendment has been made in Explanation 1(b) of Section 6 of the Income Tax Act. As per this amendment, an Indian origin seafarer, who has Indian income exceeding fifteen lakh during the financial year and is in India for more than 120 days but less than 181 days, shall be considered as a Resident in India. At the same time, another amendment has been inserted in Section 6(6) to consider the individual covered under this explanation as a resident but not ordinarily resident which makes sure that the salary earned outside India on ship will not be taxable in India but you cannot claim non-resident status.

Another new Section 6(1A) has been inserted by Financial Act 2020 which is applicable beginning from the financial year 2020-21 (01st April 2020 to 31st March 2021). As per this new section, an individual, being a citizen of India, having a total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year shall be deemed to be resident in India in that previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature (irrespective of the number of days in India)At the same time, another amendment has been inserted in Section 6(6) to consider the individual covered under above section 6(1A) as a resident but not ordinarily resident.

The plain reading of this section suggests that all the non-resident sea fearers are considered as resident Indians and their salary will be liable to tax as they are not paying tax in any other country. However, this is not the case. To clarify the applicability of this new section 6(1A), CBDT has issued a clarification via press release on 02 Feb 2020. As per this clarification, Section 6(1A) is an anti-abuse provision to cover those Indian citizens who shift their stay in low or no tax jurisdiction to avoid payment of tax in India. The new provision is not intended to cover those Indian citizens who are bonafide workers in other countries like in the Middle East as they are not liable to tax in these countries. Moreover, it is clarified that in case of an Indian citizen who becomes deemed resident of India under the section 6(1A), the income earned outside India by him shall not be taxed in India unless it is derived from an Indian business or profession.

So, the new section does not impact taxability of salary receipt by sea fearers and they will enjoy the benefit of tax-free salary as they have currently even they become resident but not ordinarily resident as per new Section 6(1A).

Also, a false news is circulated in various places that a seafarer is required to complete 8 months onboard to save tax on their merchant navy receipt which is not correct. This provision is applicable on the person who is visiting India not for a person who is leaving India for the purpose of employment.

Relief in Residency Status for COVID-19 for Financial Year 2019-20

On 08th May 2020, CBDT gives relaxation in the residency status due to COVID-19 lockout via Circular 11 of 2020 which is as follows: –

Various representation has been received that various individual who had come to visit India during the previous year 2019-20, were not able to leave India due to the outbreak of COVID-19 and declaration of lockdown. As they have to prolong their stay in India which result in genuine hardship as they may not be able to maintain their status as Non-Resident or Resident but not ordinarily resident.

(a) has been unable to leave India on or before 31st March 2020, his period of stay in India from 22nd March to 31st March 2020 shall not be taken into the account; or

(b) has been quarantined in India on account of COVID-19 on or after 01st March 2020 and has departed on an evacuation flight on or before 31st March 2020 or has been unable to leave India on or before 31st March 2020, his period of stay from the beginning of his quarantine to his date of departure or 31st March 2020, as the case may be, shall not be taken into the account; or

(c) has departed on an evacuation flight on or before 31st March 2020, his period of stay in India from 22nd March 2020, to his date of departure shall not be taken into account.

Note – It is mentioned in the circular that is applicable for the person visiting India. No mention is available whether it is applicable to the person who was unable to leave India for the purpose of employment due to lockdown. As per our view, it should be applicable to seafarers. A similar circular will also be released for the financial year 20-21 as mentioned by the Income Tax Department in their tweet of 08th May 2020 depending on the normalization of/resumption of international flights.

COVID 19 Updates – A video cutting is going viral in Merchant Navy groups that the 184 days condition has been relaxed for the FY 2019-20 due to Coronavirus which is not correct. The condition for 184 days is relaxed for the Companies in India which are required to have an Indian Director as per the Companies Act 2013 not in the Income Tax Act, 1961.

FAQ

Do Indian seafarers have to pay tax?

If you are outside India for more than 184 days (or 185 days in a leap year) as per your CDC/passport then you are not required to pay taxes on your merchant navy receipts.

Are seafarers NRI?

Yes, if you are outside India for more than 184 days (or 185 days in a leap year) as per your CDC/passport then you are considered Non-Resident India under Income Tax Act 1961.

Which bank is best for seafarers?

You can have NRE/NRO account in any PSU or private banks like ICICI, Kotak Mahindra Bank, SBI etc.

What is the difference between NRO and NRE account?

In NRE account only foreign currency or a check from another NRE account can be deposited. However, NRO is a saving account for non-resident in which you can deposit Indian currency or any cheque from normal saving account.