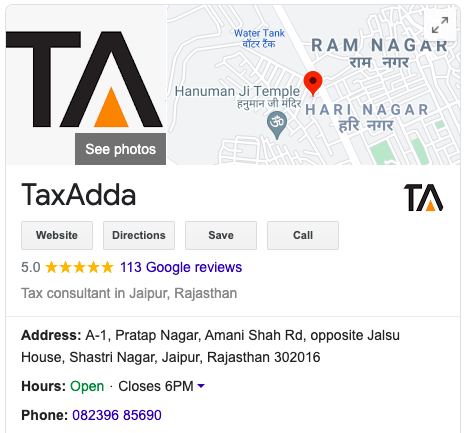

Our reviews says everything about us.

Click here to read our reviews on google.

IT Return Filing Service for Seafarer

- Onboarding new customers again

- Starting From Rs 7,000

- 82396-85690

Benefits

Return Filed by CA

Your return will be prepared and filed personally by our in-house experienced CA team having vast experience.

After Service Support

We will answer all of your questions regarding tax return even after filing your tax return.

Answer to Notices

We will do all the thing until your income tax return is successfully processed at Income Tax Department.

Timely Submission

We will submit your income tax return within a period of 5 days from the date of submission of all details.

Things Covered

All Incomes

We cover all types of income whether it is Salary, Capital Gain, Business, Retirement Benefits, Multiple Employer, Non- Resident etc.

Registration

We will also register your PAN Card on the e-Filing website if you are not registered. We always use your personal mobile number and email.

Sharing Complete Details

We will share all the login details with you along with Computation, ITR-V, XML etc. Every document will be shared with you for your future reference.

Our Reviews on Google

Click here to read all of our reviews on google.

Where we Stands

What I will get?

100% Satisfaction Guaranteed

- Proper tax return filing by our CA Team

- All relevant documents related to your filed return

- Complete support for your tax return queries

- Timely submission of Income Tax Return